Restructure your debt, release cash, use it smarter

What if you could clear debt faster and save thousands — without spending a penny more? It’s possible with a few simple changes to how you manage your money.

Combine Debts to Cut Waste

Move high-interest debts into one lower-cost loan (like your mortgage) to reduce payments and interest.

01

Free Up Cash Each Month

Lower repayments = more room in your budget.

02

Put That Money to Better Use

Redirect what you’ve freed up to:

03

- Overpay your mortgage and clear it faster

- Invest to build long-term savings

The power of reallocating your money

Real example

- £1,186/month on your mortgage

- £500/month on personal debts (credit cards, loans)

That’s £1,686/month total — and much of it is going toward interest.

01

Consolidate

Combine mortgage & debts into new £215,950 mortgage over 25 years.

New monthly payment: £1,134.

You’ve just freed up £552/month without cutting back.

02

Redirect

saved £552

saved £552

Use £450/month to overpay your mortgage

03

It’s now paid off 10 years earlier

Invest the rest

Put the remaining £102/month into an investment earning 8%

Over 15 years, that could grow to £35,000+

04

Mortgage-free 10 years early, £60,000 saved in interest, £35,000 invested — all with the same monthly spend.

Mortgage-free faster, without changing your lifestyle.

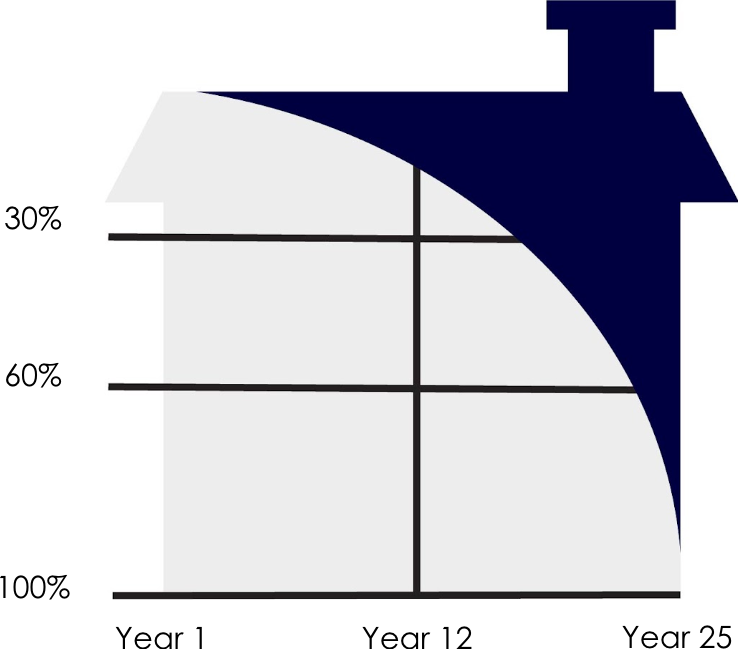

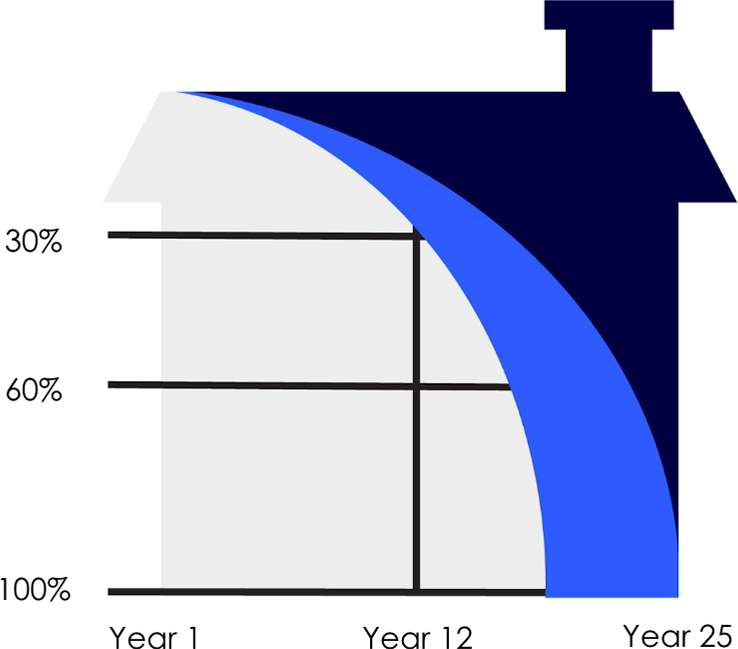

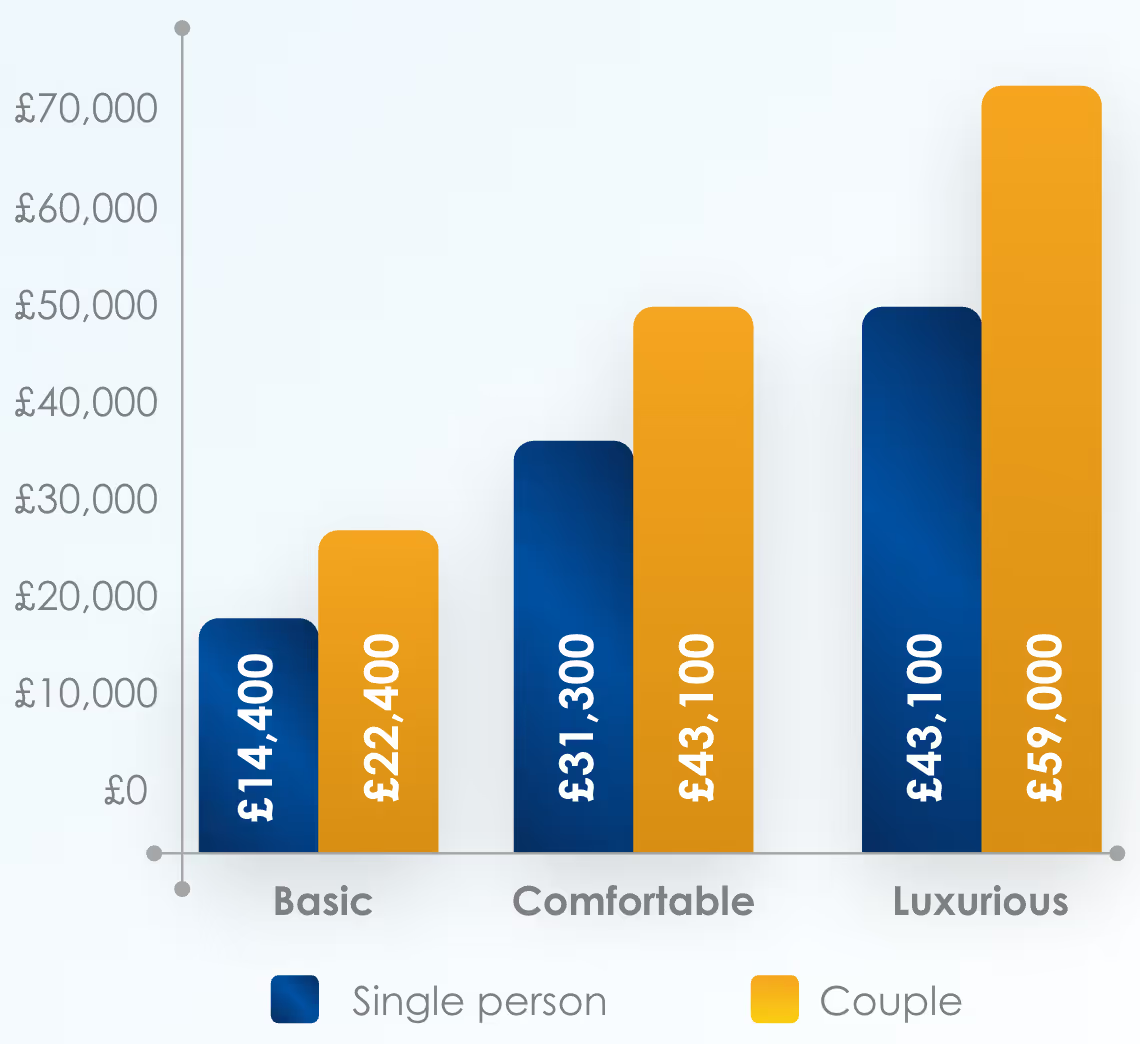

Most people pay their mortgage monthly; switching to fortnightly payments reduces interest and pays off mortgage faster. The following example is based on a £225,000 loan amount.

Total Cost: £356,140, Interest Paid: £131,140

Total Cost: £336,474, Interest Paid: £111,913

This example of saved £18,974 and 4 years off the term

Debt Stacking, a smarter way to pay off debt

Debt stacking is a strategy that helps you pay off your debts faster and cheaper.

Pay debt faster, save thousands!

In this £20,000 debt example, debt stacking could cut the repayment time by half and save around £2,771 in interest — without increasing the monthly payments.

| Debt | Monthly Payment | Monthly Payment | Monthly Payment |

| Credit card | £100 | ||

| Store card | £150 | £250 Roll payment  | |

| Loan | £200 | £200 | £450 Roll payment  |

| Monthly amount | £450 | £450 | £450 |

Adding just £50 a month could save over £1,500 more in interest and clear the debt even faster.

See how much you can save in your Financial Plan

.avif)